Personal Injury Protection (PIP) insurance is a crucial component of auto insurance, covering medical expenses for all parties involved in an accident, regardless of fault. The 14-day rule, a key aspect of PIP insurance, requires policyholders to notify their insurer within two weeks of an accident. Adhering to this timeline ensures access to benefits, prevents fraud, and facilitates fair claims handling. After a collision, immediate priorities include safety and medical assessment, with the 14-day rule influencing treatment and claims processes. Accurate injury documentation is essential for claim processing, while understanding local regulations is vital for navigating the claims process smoothly. Long-term care strategies post-accident are crucial for comprehensive healing, including rehabilitation and support services beyond the 14-day mark.

After a collision, focused care is paramount for injury victims. This comprehensive guide delves into essential aspects of managing post-crash healthcare, including understanding PIP insurance and its coverage. We explore the critical 14-day rule, emphasizing immediate priorities for crash survivors to ensure accurate documentation of injuries and informed navigation through the claims process. Learn about your rights, long-term care strategies, and recovery paths, empowering you with knowledge to navigate this challenging period effectively.

- Understanding PIP Insurance: A Comprehensive Overview

- The 14-Day Rule: What It Means for Collision Victims

- Immediate Priorities After a Crash: Ensuring Focused Care

- Documenting Injuries: Steps to Accurately Record Medical Needs

- Navigating the Claims Process: Your Rights and Entitlements

- Post-Collision Support: Long-Term Care and Recovery Strategies

Understanding PIP Insurance: A Comprehensive Overview

PIP, or Personal Injury Protection, insurance is a crucial component of auto insurance policies in many regions. Its primary purpose is to cover medical expenses for drivers and passengers involved in accidents, regardless of fault. This comprehensive overview aims to demystify PIP insurance, especially regarding the 14-day rule.

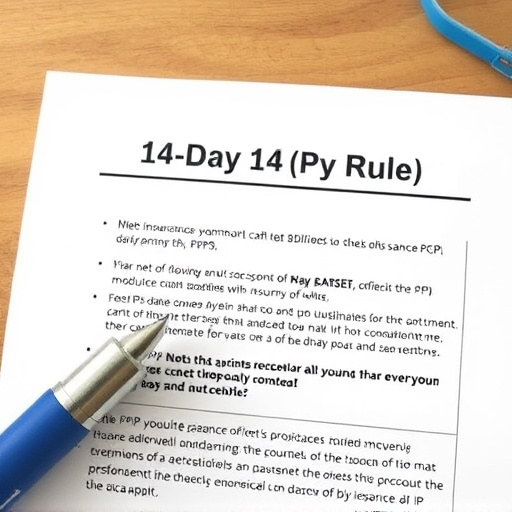

The 14-day rule dictates that an insured individual must notify their insurance provider about an accident within a specified timeframe, usually two weeks. Failure to comply with this rule can lead to a denial of PIP benefits. It’s essential to understand that this process is designed to ensure timely claims handling and prevent fraudulent activities. Prompt reporting enables insurance companies to assess and manage medical bills effectively, protecting both the insured and the insurer from potential misuse of policy benefits.

The 14-Day Rule: What It Means for Collision Victims

In the aftermath of a collision, understanding the legal and financial implications is crucial for victims seeking focused care. One significant concept to be aware of is the 14-Day Rule, which is closely tied to PIP (Personal Injury Protection) insurance. This rule stipulates that individuals involved in car accidents must typically seek medical attention within 14 days to maintain their right to claim benefits under their PIP coverage. The primary purpose of this regulation is to ensure timely treatment for injuries sustained during the collision, preventing any potential delays in claiming compensation.

For collision victims, adhering to the 14-day time frame is essential as it allows for a seamless process when filing claims with their insurance providers. It also ensures that medical records and treatments are properly documented, which is vital for supporting injury-related claims. Additionally, prompt medical attention can significantly contribute to effective recovery and rehabilitation, ultimately enhancing the overall outcome for victims navigating the aftermath of a collision.

Immediate Priorities After a Crash: Ensuring Focused Care

After a collision, the immediate priorities for both victims and responders are clear. The first step is to ensure everyone’s safety by moving them to a secure location if necessary, and calling emergency services. Once stability is achieved, focused care should begin, with a particular focus on severe injuries. This involves rapid assessment and treatment, which can significantly impact recovery outcomes.

In many jurisdictions, the PIP (Personal Injury Protection) insurance 14-day rule plays a crucial role in this process. It mandates that medical attention be sought within a specific timeframe to facilitate fair compensation for injuries sustained in accidents. Adhering to this rule ensures that victims receive necessary care and helps streamline the claims process, providing a structured approach to post-crash healthcare.

Documenting Injuries: Steps to Accurately Record Medical Needs

When documenting injuries sustained in collisions, it’s crucial to follow a systematic approach to accurately record medical needs. This process begins immediately after the incident, with a thorough assessment of the injured party. Medical professionals should meticulously document all visible signs of injury, including but not limited to lacerations, fractures, and soft tissue damage. It’s equally important to capture any immediate symptoms, such as pain levels, numbness, or difficulty moving affected body parts.

In many jurisdictions, PIP (Personal Injury Protection) insurance has a 14-day rule that requires policyholders to notify their insurer about medical treatment within this timeframe. Adhering to this rule is essential for ensuring smooth claims processing. Accurate documentation of injuries not only facilitates faster claim settlements but also serves as a testament to the extent and nature of the harm sustained, which can be pivotal in navigating legal procedures related to collisions.

Navigating the Claims Process: Your Rights and Entitlements

Navigating the claims process after a collision can be challenging, but understanding your rights and entitlements is crucial. As soon as an accident occurs, it’s essential to be aware of the steps to take to protect yourself and ensure fair compensation. In many jurisdictions, individuals involved in car crashes have access to Personal Injury Protection (PIP) insurance, designed to cover medical expenses and other related costs without needing to sue.

One important aspect is recognizing the 14-day rule associated with PIP insurance. This means you typically have 14 days from the date of the incident to notify your insurance provider about the collision. Delving into this process early ensures that your rights are preserved, and you can access the necessary support without undue delays. Remember that each region has its own regulations, so understanding local laws is vital for a smooth claims journey.

Post-Collision Support: Long-Term Care and Recovery Strategies

After an initial assessment and treatment for immediate injuries, long-term care and recovery strategies become essential for those involved in collisions. This phase often involves a multifaceted approach to ensure comprehensive healing and rehabilitation. Many factors can influence the duration and intensity of this process, including the severity of injuries and individual patient needs.

One key aspect is continued support beyond the initial 14-day rule set by PIP (Personal Injury Protection) insurance. This period is crucial for monitoring and managing pain, addressing potential complications, and providing the necessary resources for a successful recovery. Long-term care may include physical therapy, counseling to cope with trauma, and adaptive strategies to regain independence in daily living activities. These strategies are vital for fostering resilience and enabling individuals to navigate their journey towards full healing and restored well-being.